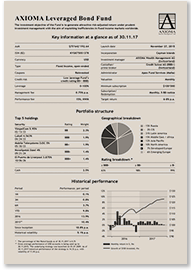

AXIOMA Leveraged Bond Fund

Performance

November 2025Period

Performance, per period

| Historical volatility p.a. | 9.65 |

| 1M | 0.24 |

| 3M | 2.58 |

| YTD | 9.94 |

| 2024 | 6.84 |

| 2023 | 4.04 |

| 2022 | -22.34 |

| Since inception p.a. | 3.80 |

Investment objective

The investment objective of the Fund is to generate attractive risk-adjusted return under prudent investment management with the aim of exploiting inefficiencies in fixed income markets worldwide.

| Top 5 issuers | Rating | Weight |

| Cash/leverage | 2.4% | |

|

Adani Ports & Special Economic Zone Ltd |

BBB- | 2.6% |

|

ICTSI Treasury BV |

NR | 2.5% |

|

Promigas SA ESP / Gases del Pacifico SAC |

BBB- | 2.5% |

|

Egypt Government International Bond |

B | 2.5% |

|

Thaioil Treasury Center Co Ltd |

BBB- | 2.4% |

Allocation November 2025

33% Latin America

33% Latin America

13% Developed Europe

13% Developed Europe

20% Asia Pacific

20% Asia Pacific

4% Emerging Europe

4% Emerging Europe

15% Middle East / Africa

15% Middle East / Africa

3% CIS

3% CIS

12% North America

12% North America

0% Russia

0% Russia

Fund details November 2025

| AuM | 115'858'749.61 |

| ISIN (B1 / B2) | KYG0750S1295 / KYG0750S1378 |

| Currency | USD |

| Type | Fixed Income, open-ended |

| Coupons | Reinvested |

| Credit risk | Median (average Fund’s credit rating BBB-) |

| Leverage | 0-100% |

| Management fee (B1 / B2) | 0.5% p.a. / 0.75% p.a. |

| Performance fee | 15%, HWM |

| Launch date (B1 / B2) | November 27, 2015 / July 01, 2016 |

| Incorporation | Cayman Islands |

| Investment manager | AXIOMA Wealth Management AG (Switzerland) |

| Custodian/prime-broker | Credit Suisse AG (BBB) (Switzerland) |

| Administrator | Apex Fund Services (Malta) |

| Valuation | Monthly |

| Minimum subscription | $100’000 |

| Subscription/Redemption | Monthly, 5 BD notice |

| Target return | 4-6% p.a. |

Information at a Glance

Commentary

November 2025Fixed income markets remained defensive throughout November, shaped by a dearth of economic data amid the U.S. government shutdown, the longest on record. In this environment, market movements were driven by isolated data releases, hawkish commentary from Federal Reserve officials, mid-month equity weakness, and global spillover effects. Against this backdrop, the Fund delivered a positive return of 0.2%*. The UST 10-year yield declined slightly from 4.078% to 4.015%, reflecting a modest risk-off tone. Although the shutdown officially ended on November 12, it failed to restore clarity, with investors still awaiting a backlog of delayed data. Notable releases included strong October ADP employment figures, firm ISM services data, and solid September payrolls. Meanwhile, rising Japanese government bond yields added indirect upward pressure on U.S. rates. Despite shifting expectations for Fed policy and a heavy Treasury auction calendar, markets remained resilient. Fixed income indices broadly ended the month flat to slightly positive, as falling Treasury yields were offset by wider credit spreads. The Fund participated in a tender offer from a Brazilian media company, contributing to a reduced Brazil weighting. The current strategy remains focused on improving credit quality amid tight spreads, while retaining selective EM exposure in names offering favorable risk/reward. As of month-end, the Fund held an average duration of 5.9 years and a yield-to-maturity of 5.7%. * Net performance, B1 shares